1. Introduction

Knowledge graphs are being used for a wide range of applications

from space, journalism, biomedicine to entertainment, network

security, and pharmaceuticals. We cannot do justice to discussing

the full range of knowledge graph applications in this short

chapter. Therefore, we have chosen the financial industry vertical

for which we will describe three different flavors of knowledge

graphs: analytics, tax calculations and financial reporting. The use

of knowledge graphs for analytics is probably the most common

usage. The use of knowledge graphs in tax calculations (or, more

generally, for financial calculations), is similar to their usage in

compilers and programming languages. Use of knowledge graphs for

exchanging reporting data is an emerging area of application that

will likely become increasingly important in the future.

2. Knowledge Graphs for Financial Analytics

Consider a large financial organization such as a bank that must deal with

millions of customers some which are companies, and some are individuals. Such

organizations routinely face questions that can be instantiated from

the following templates.

- If a company goes into financial trouble, which of our clients are its suppliers and vendors? Are any of those applying for a loan? How much of their business depends on that company?

- In a supply chain network, is there a single company that connects a group of companies?

- Which startups have attracted the most influential investors?

- Which group of investors tend to co-invest?

- Which companies are most similar to a given company ?

- Which company might be a good future client for us?

To answer the first question above, we need data about suppliers

and vendors of a company. Such data are usually available through

third party data providers and must be purchased. The external data

about the suppliers and the vendors must be combined with a company's

internal data. Doing so leverages the techniques of schema mapping

and entity linking that we considered in Chapter 4 for creating a

knowledge graph from structured data. Increasingly, institutions are

starting to leverage data from the daily news for market intelligence.

To leverage the financial news, we will need to extract information

from the text using the entity extraction and relation extraction

techniques described in Chapter 5. Once a knowledge graph is built, we

can use path finding algorithms considered in Chapter 6 to answer this

query. Assuming our knowledge graph represents the supplier and vendor

relationships between the companies, the traversal algorithms need

traverse those relationships to answer the query. The query results

may benefit if we use a simple visualization of the supply chain. To

answer the second question, we can leverage the centrality detection

techniques. In particular, the betweenness centrality is one possible

approach for identifying the company that plays a central role in a

supply chain.

The third question above is clearly relevant to the valuation of a

startup. Just as in the first question, the answer requires getting

data about investments from a third-party provider, and integrating it

with the internal customer data. Answering the query requires using

centrality detection techniques that we considered in Chapter 6. In

particular, the graph adaptation of the page rank algorithm is an

appropriate technique for answering this question. The answer

presentation will benefit by showing a graphical visualization of how

the influential investors are connected to various startups they are

involved in. The fourth question is an example of community

detection. In a knowledge graph that captures the investment

relationships, the investors who co-invest in a company often will

form a community.

The fifth and sixth questions are examples of reasoning techniques

based on graph embeddings that were briefly introduced in chapter

1. Fifth question can be answered using techniques for calculating

similarity based on the embedding vectors for the nodes of

interest. Sixth question is an instance of the link prediction

problem in a graph which is very similar to the problem addressed in

language models. Here, instead of predicting the next word, we are

interested in predicting the most likely links from a given node.

3. Knowledge Graphs for Income Tax Calculations

The income tax law in United States consists of more than 80,000

pages of text. Every year, more than 150 million income tax returns

are filed. The US tax law includes thousands of forms and

instructions that can appear in an income tax return. The requirements

change every year, and sometimes, can even change in the middle of a

tax filing year. With the advent of the income tax preparation

software, this difficult to understand body of law has been made

accessible to end-users so that they can prepare and file their income

tax return on their own.

Some income tax preparation tools represent the income tax law

using a set of rules. Once the law is represented as rules, it can not

only be used for calculations, but also for generating user dialogs,

providing explanations, checking completeness of input, etc. While

the calculation of income tax requires rule-based reasoning similar to

what we considered in Chapter 6, but many of the supporting operations

such as generating user dialogs, determining the effect of changing a

rule to the rest of the system, are achieved by modeling the rules as

graphs, and using graph-based algorithms to perform those

computations. To illustrate such use of the knowledge graphs,

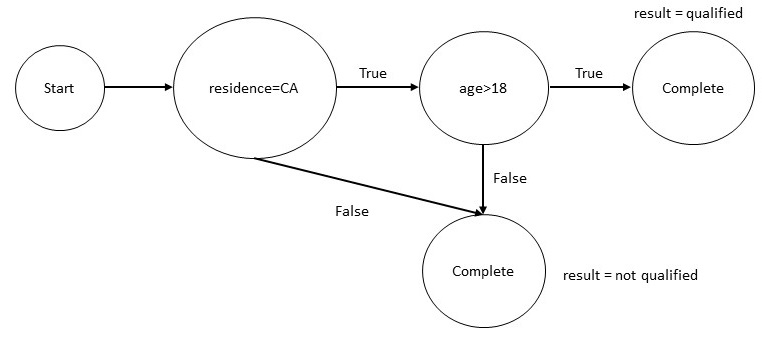

consider the following rule from the income tax law.

A person is qualified for a tax benefit if:

- the person is a resident of California, and

- the age of the person is greater than 18 years.

We can express this rule as a Datalog rule as shown below.

|

qualified_for_tax_benefit(P) :- |

| resident_of(P,CA) & age(P,N) & min(N,18,18)

|

Given the rule above, we can construct a knowledge graph shown below.

If we are preparing the tax return for a person whose age is 17

years, through a reachability analysis on the above graph, we can

determine that in all cases, the person will not be qualified, and

hence it is not even necessary to determine their residence. The above

example is small as it involves only a single rule. But, as stated

earlier, thousands of rules are applicable to a person, and in

practice, such analysis needs to be performed on a very large and

complex graph.

3. Knowledge Graphs for Financial Reporting

The financial institutions are required to report the derivative

contracts that they currently hold. The examples of such contracts

include interest rate and commodity swaps, options, futures and

forwards, and various asset-backed securities. Such reports are of

interest to the compliance teams within an organization, brokers and

dealers who need to understand and manage such portfolios, and

regulators who need to analyze and oversee these markets. If each

financial institution provides such reports in a different format, it

becomes challenging for these diverse set of stakeholders to process,

aggregate and make sense of these reports. This problem is a classic

instance of the data integration problem that knowledge graphs are

meant to address.

An industry-wide initiative to address this problem has taken the

approach of defining a common semantic model, called, Financial

Industry Business Ontology (FIBO). FIBO is defined using a formal

language called Web Ontology Language (OWL). FIBO defines things

that are of interest in financial business applications and the ways

those things can relate to one another. In this way, FIBO can

give meaning to any data (e.g., spreadsheets, relational databases,

XML documents) that describe the business of finance. FIBO concepts

have been developed by a community of users coming from multiple

financial institutions and represent a consensus of the common

concepts as understood in the industry and as reflected in industry

data models and message standards.

FIBO provides the concepts and terminology required for reporting

on derivatives. To help users in getting started with FIBO, the developers

have provided examples to get started with modeling basic concepts such

as a Company, its global legal identifier, the derivatives, etc.

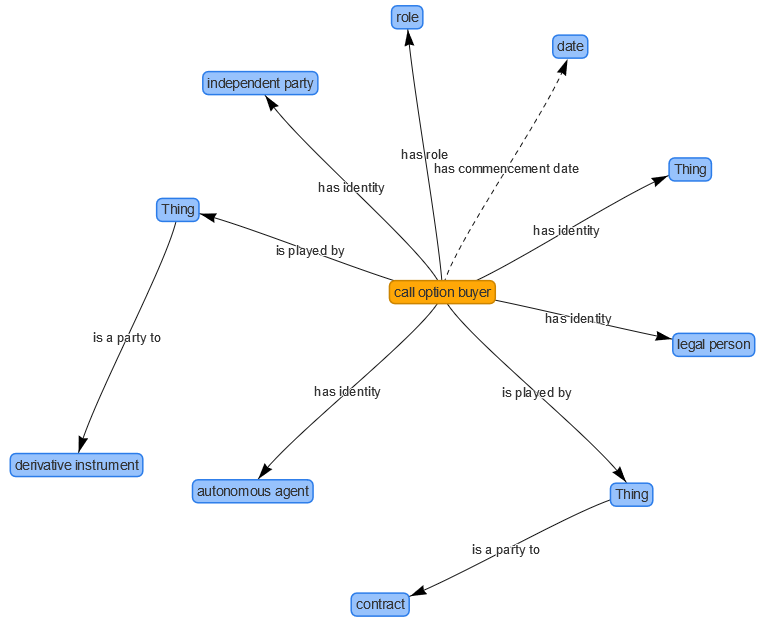

For example, FIBO defines that a Derivatives Contract could have has part

one or more Options. An Option can have a call option buyer. We show

below a graphical view of connections from a call option buyer to related

entities in the diagram below.

The graph shown above is an ontology graph in the sense that it

does not capture the relationship between data values but the

relationships that exist at the schema level. For example, it

captures that a call option buyer has to be an independent party, a

legal person and an autonomous agent. When a financial institution

uses the terms and definitions from FIBO for the financial reports

it generates, it provides the foundation for integrating its reports

with reports coming from other providers. Use of FIBO can lead to

significant streamlining and reduction of costs in aggregating and

understanding the information about derivatives contract.

The development of FIBO is being driven by a set of motivating use

cases. Derivatives contracts are only one of the several use cases

under consideration. Other use cases include counter party

exposure, index analysis for ETF development, and exchange

instrument data offering.

4. Summary

Knowledge graphs have wide-ranging applications across multiple

industries. In this chapter, we chose to focus on three different uses

of knowledge graphs in financial industry: analytics, calculations and

reporting. Use of knowledge graph for analytics is the most

mainstream and wide-spread use of knowledge graphs as it has the

potential to offer novel insights into data that an organization may

already have. Use of knowledge graph for computations has been around

for quite some time as it is similar to the use of graphs in compilers

and rule engines for various reasoning and analysis tasks. Finally,

the use of ontologies in data exchange is an emerging area for

knowledge graphs with tremendous potential that will be increasingly

important and mainstream in the future.

|